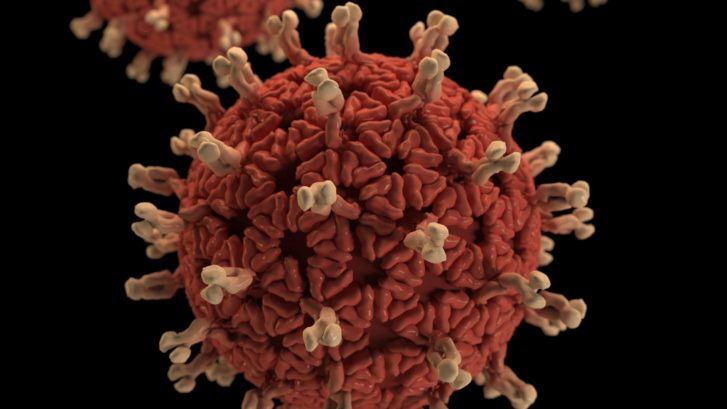

As the virus spreads further beyond China, economic uncertainty is increasing. But similar to previous health crises Project Finance Initiatives are best positioned overcome them. Particularly in the long-term market context, this is not the first health crisis that financial markets and PFIs have endured. Instead of overreacting and as difficult it may be, prudent investors tend to seek opportunities outside financial markets and also focus on infrastructure asset classes.

WIDER INVESTOR CONTEXT

Despite the virus picking up momentum, there hasn’t so far been a significant impact on economic activity outside of China.

Latest data released last week suggests that Japan’s manufacturing sector has taken a hit, but that’s currently not the case for the other major economies. And in fact, UK and Eurozone manufacturing activity indicators rose in February.

That said, there’s no denying that economic activity in the first quarter of 2020 will be affected by this outbreak. Kenneth Meyer, Senior Investment Advisor, says, “It’s a consequence of having globally-connected markets and supply chains, making isolation of problems more difficult than before. We shouldn’t be surprised to see pockets of volatility in the weeks ahead. Against the backdrop of a deteriorating economy, the Chinese authorities are likely to launch new stimulus measures such as interest rate cuts and tax cuts. In developed countries there is a growing concern about supply chain disruptions however fundamentals remain stable; low bond yields and accommodative central banks should help to overcome short-term economic headwinds.”

“Given the good liquidity in markets we believe there is support for a longer-term bounce-back, once current concerns have passed. This would be underpinned by the positive turn in economic activity that started in October 2019, well before the virus started. There is, of course, never any guarantee.”

KENNETH MEYER, SENIOR INVESTMENT ADVISOR

OUR LONG-TERM STRATEGY

The impact of the virus is impossible to predict, and as always it’s important for investors to avoid overreacting and to stay invested for their longer-term goals.

As Kenneth explains, there are underlying reasons why investors can afford to look beyond the short-term concerns: “Given the good liquidity in markets, we believe there is support for a longer-term bounce-back, once current concerns have passed. This would be underpinned by the positive turn in economic activity that started in October 2019, well before the virus started. There is, of course, never any guarantee.

Long-term thinking can make a real difference in these situations.”

Financing ❂ Re-Imagined, Value ❂ Re-delivered

We are Always Here to make financing happen!

[/vc_column_text][/vc_column][/vc_row]