Chinese EVs and PHEVs Find New Life as Second-Hand Exports in the EU/EEA, EMEA & Sanctioned Markets of Iran and Russia

14-JUNE, 2024 — New research conducted by ICONIC Project Finance Advisory (IPFA) reveals a rising trend in the export of virtually any Chinese EVs and PHEVs as second-hand cars, with a notable increase in parallel export volumes directed towards EU/EEA, EMEA Region. Although the main destinations for these exports used to be Central Asia and the Middle East, today exporters are targeting the EU/EEA market where demand and trade conditions are favorable for Chinese second-hand EVs.

Dubbed as New Electric Vehicles (NEVs), according to the research those vehicles are also likely to be further re-exported to sanctioned markets such as Iran and Russia.

Despite the challenges posed by sanctions, the flexibility and lower regulatory barriers of the second-hand vehicle market provide a feasible route for these NEVs to enter restricted areas indirectly. The ease of parallel export procedures, combined with high demand and lucrative profit margins makes all these regions —including the sanctioned ones— attractive secondary markets. Data shows a rapid increase in second-hand car exports, with figures rising from 15,123 vehicles in 2021 to around 70,000 in 2022. ICONIC’s Industry insiders estimate that from January to May this year, approximately 50,000 second-hand cars were exported, with at least 80% being NEVs (2024Q1-Q2).

Particularly in the EU/EEA region used NEVs present major yet addressable challenges related to product quality, after-sales services, and localization that importers need to deal with in their effort to ensure long-term success.

Nevertheless, used NEVs remain in high demand overseas. The trade volume of these exports surpassed 7 billion RMB (approximately USD1.08 billion).

Yiorgos Andrianopoulos, Chief Automotive Research Analyst, stated—

«At IPFA, our research reveals a significant trend of Chinese NEV being exported as second-hand cars to around the world. Brands like BYD are leading this surge, particularly with EVs and PHEVs premium sedans and mid-market hatchbacks.This growth underscores the global demand for NEVs (New Energy Vehicles) and highlights innovative market adaptations, despite challenges in product quality and after-sales services.

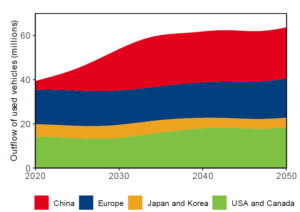

Chinese vehicle sales grew rapidly between 2010 and 2024, culminating in 2017 with 24.8 million units sold. This resulted in a rapidly expanding and relatively new vehicle stock. The average estimated lifetime of a vehicle in China is 17 years until it leaves the domestic fleet. These vehicles will either be dismantled domestically (scrapped) or exported in the EU/EEA and EMEA region. However, used NEV exports usually have a younger stock outflow share, whereas older cars are more likely to be scrapped. Following the rapid increase in vehicle sales in the last decade, the number of vehicle outflows from the Chinese stock is set to increase rapidly this decade».

In the parallel export trade, BYD emerges as a significant player. The high volume of BYD vehicles exported in this manner prompted the company to issue a notice that vehicles purchased from unauthorized dealers overseas would not be covered by warranties.