Success for IPFA Project Finance Advisory is when our clients meet their goals. Our sophisticated project finance and syndication solutions, our delivery track record in the shipping industry, operational excellence and deal closing for all our FPSOs demonstrated it.

As part of our ongoing success, IPFA Project Finance Advisory advised SMBC (Sumitomo Mitsui Banking Corporation ) on an approximate EUR1.1 billion financial facility to Tartaruga MV29 B.V. (TARMV29), which is incorporated in the Netherlands. Each of MODEC, Inc. (MODEC), Mitsui & Co., Ltd., Mitsui O.S.K. Lines, Ltd. and Marubeni Corporation have an equity stake.

(Download in High Resolution; Courtesy of IPFA Project Finance Advisory)

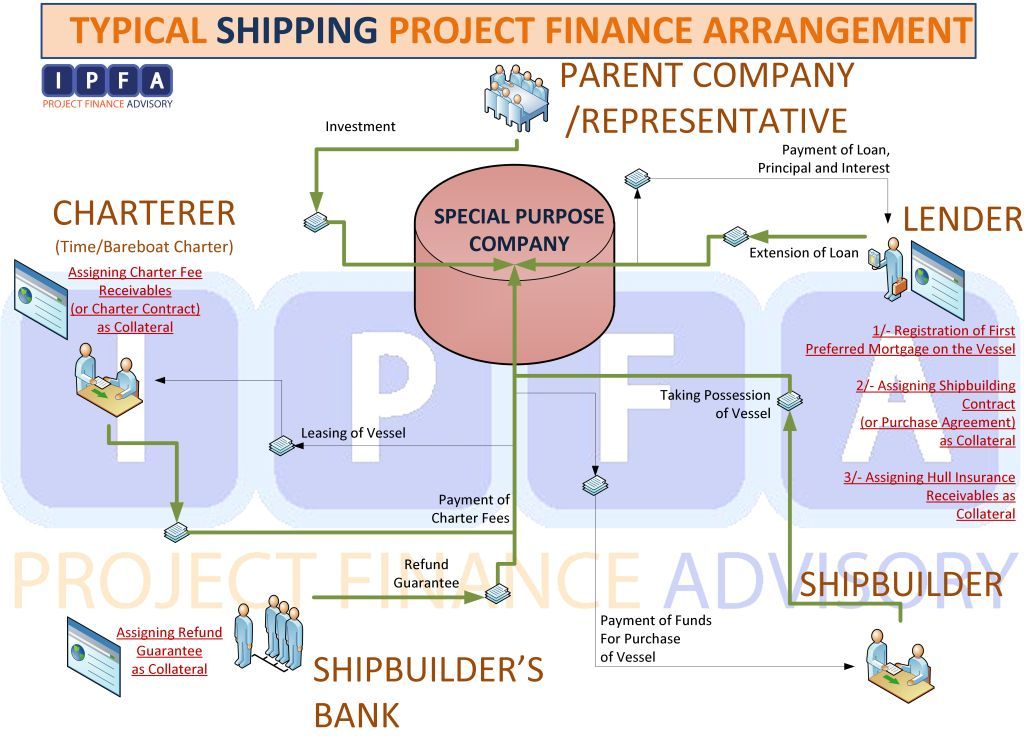

IPFA Shipping Project Finance Arrangement

(Download in High Resolution; Courtesy of IPFA Project Finance Advisory)

The facility has been provided as project financing and will support a project in which a long-term Floating Production Storage and Offloading (FPSO) chartering service is offered to Brazilian state-owned oil company Petróleo Brasileiro S.A. (Petrobras) for 20 years.

The FPSO unit capacity is up to 150,000 barrels of crude oil and 176,000,000 cubic feet of gas per day, and store about 1,600,000 barrels of crude oil. The unit is the ninth FPSO chartered to Petrobras by MODEC and is to be moored in the Tartaruga Verde and Tartaruga Mestica oil fields, offshore Brazil in waters 765 metres deep.

The syndicate of lenders includes ING and SMBC as coordinating banks, and Mizuho Bank, Ltd., Overseas-Chinese Banking Corporation Limited, Clifford Capital Pte. Ltd., The Bank of Tokyo-Mitsubishi UFJ, Ltd., DVB Bank SE, Natixis, Sociètè Gènèrale, Mitsubishi UFJ Trust and Banking Corporation, Sumitomo Mitsui Trust Bank, Limited and Crèdit Industriel et Commercial as co-financers.

The portion of the loan provided by the syndicate is around US$1.01 billion, and an additional US$252 million was provided by the Japan Bank for International Cooperation (JBIC), the Japanese export credit agency.

Gordon Batman, Executive Vice President and Business partner, IPFA commented:

“Despite the challenges currently facing Brazil’s economy this syndicated financing demonstrates the confidence in Brazil’s offshore oil and gas sector, which is considered to be the most promising market for the FPSO sector.”

“Floating production, storage and offloading vessels are particularly effective in remote or deep water locations, where seabed pipelines are not cost effective.

“This current FPSO shall eliminate the need to lay expensive long-distance pipelines from the processing facility to onshore terminals, so that an economically attractive solution for smaller oil fields is provided. Furthermore, once the field is depleted, this FPSO can be moved to a new location.”

Yiorgos Andrianopoulos, Senior Infra & Project Finance Business Partner, IPFA pointed out:

“…We worked together across international offices to achieve the financial close and this is one of numerous FPSOs and drilling units we have now advised on offshore Brazil as a global team.”

“Macro drivers like the oil price and E&P expenditure drive demand for oil processing systems in general and we expect this will also boost FPSO demand.

“Despite the prolonged decline in crude oil prices which has started to shake the floating production, this investment has been designed for remote locations. Deeper drilling and smaller fields drive demand for versatile solutions like FPSOs that can operate in deep waters and are not bound by a fixed locations.”