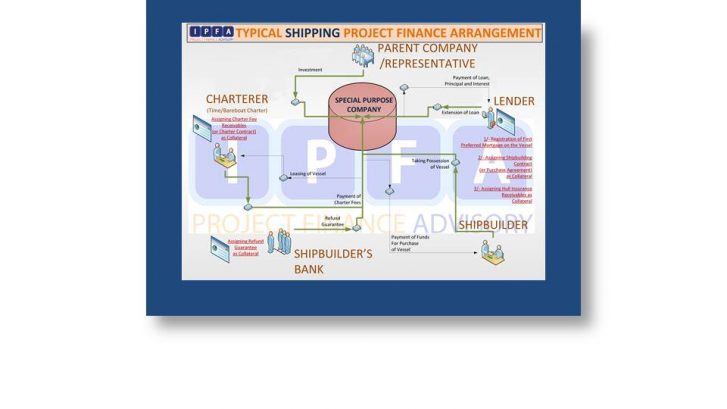

Ship Project Financing is a method of raising funds whereby risks are mitigated by the registration of various forms of collateral while charter fees serve as the principal source of repayment.

(Download Photo in High Resolution; Courtesy of IPFA Project Finance Advisory)

IPFA Project Finance Advisory uses its wealth of experience and proven track record in this area to help customers obtain long–term funding to use in purchasing vessels (both newly built and used).

- Parent company/representative with the active support of IPFA Project Finance Advisory invests in a Special Purpose Company (SPC), usually a subsidiary, that is primarily established to serve as borrower.

- IPFA Project Finance Advisory prepares a pitch book on behalf of the SPC. We consequently aim at concluding a loan agreement with a banking institution so as the SPC borrows funds for the purchase of the vessel.

- IPFA Project Finance Advisory supports the SPC in assigning various forms of collateral including the mortgage on the vessel, the shipbuilding contract (or purchase agreement; including refund guarantee), the hull insurance receivables, and the charter fee receivables (or charter contract).

- The SPC uses the funds obtained to pay for the vessel, and takes its possession from the shipbuilder.

- The SPC leases the vessel to a charterer and receives charter fees in return.

- The SPC uses the charter fees received to pay back the principal and interest of the loan. (The arrangement depicted above is for a loan to a subsidiary for a vessel registered in Panama, which is the most common type of ship financing transaction that IPFA Project Finance Advisory engages in. Arrangements different from the one depicted above are possible, depending on where the vessel is registered, and whether a time charter or bareboat charter is used.)

- IPFA Project Finance Advisory negotiates terms and conditions that are routinely determined on a case by case basis.

Benefits

By assigning collateral such as the mortgage on the vessel, the shipbuilding contract (or purchase agreement), the hull insurance receivables, and the charter fee receivables (or charter contract), long–term financing to use in purchasing a vessel can be obtained.

Typical Lending Terms and Conditions

Eligible vessels

Cargo–carrying vessels including bulk carriers and container ships, chemical tankers, product tankers, pure car carriers, LPG tankers, and woodchip carriers.

Loan amount

The amount of the loan will be based on a comprehensive determination of the profitability of the transaction, and will not exceed the price of acquiring the vessel.

Loan period

The loan period will be for the duration of the charter contract (including the construction period). A repayment schedule will be set in order to ensure that the actual repayment period will be within the legally–defined depreciation period (e.g., full payout in 15 years for a newly–built bulk carrier).

(Download Photo in High Resolution; Courtesy of IPFA Project Finance Advisory)

To contact our Ship Financing Team please address your enquiry directly to

yiorgos.andrianopoulos@ipfa.finance