Modern Approach to Common Ship Financing Hurdles

THIS IS THE SEA

The maritime finance environment is currently characterized by tighter regulatory requirements, limited lending, and unsettled investors.

Unprecedented uncertainty sparks new ship finance conundrum and definitely the once-common adequate supply of credit for the shipping industry no longer applies.

As a result, ICONIC taps alternative sources of capital and attracts different investors for the maritime industry.

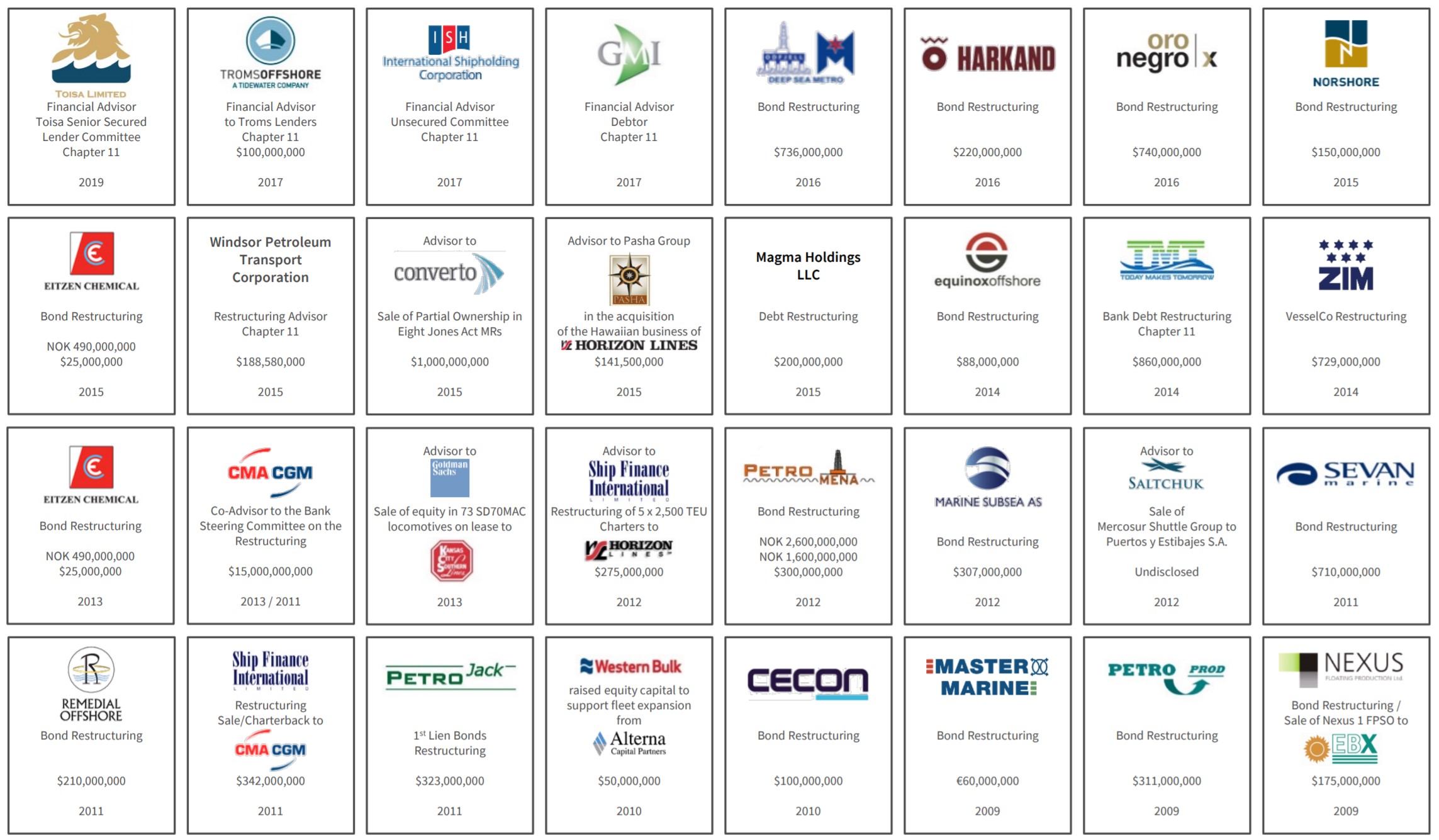

ICONIC has advised banks, bondholders, investors and companies in transactions covering $27B of capital.

Over the past decade our ICONIC Ship Financing Team has unlocked significant value for the ship owners by delivering insight, guiding the business in realizing the power of their organization and driving sources of finance.

Ship Project Finance alongside alternative investment fund managers, Institutional Investors and Ship Leasing schemes gradually replace equity and debt financing

Nevertheless, the recent unusual economic cycles are expected to see even more mergers and acquisitions (M&A’s) triggered by mega-players willing to enter the market and numerous investors that are interested in the maritime industry.

Simplified organizational structures, genuine seafarer’s culture and acts of nepotism that have long kept the maritime industry away from modern financing sources is a just a trip down memory lane.

ICONIC EXPERIENCE IN THE SHIP FINANCING INDUSTRY

Ship Project financing is an arrangement that uses vessel charter fees as the principal source of repayment, while various forms of collateral structured around shipbuilding and charter agreements are assigned to mitigate credit risk.

We leverage our wealth of experience and proven track record in this area to help ICONIC Business Partners obtain long–term funding to purchase vessels, both new and used.

From full investment banking services to project finance and bespoke asset finance solutions to freight and commodity futures broking we help our clients manage risk, fund transactions and conclude deals that would often be impossible via other, more traditional routes.

ICONIC provides a unique cross section of professional skill sets and human resources.

❂ We are independent – no ancillary agendas – our success is aligned with that of our Business Partners.

❂ Pro-active senior level attention from our dedicated Ship Financing Team.

❂ Long-term industry relationships at all levels providing both project, corporate and asset level insight.

❂ Direct access to decision makers representing a variety of capital sources seeking investments in different layers of the capital structure.

❂ ICONIC is viewed by many as a “bridge” between the financial and operating world – ICONIC distills the value proposition and has an appreciation for issues related to asset finance.

FEATURED SHIP FINANCING ADVISER

YIORGOS, ANDRIANOPOULOS

CFO | SENIOR PROJECT FINANCE INVESTMENT ADVISER

Yiorgos.Andrianopoulos@IPFA.FINANCE

Browse by

Our global structure allows us to better serve the strategic and financing needs of our Business Partners across all geographies and industries.

Your

ICONIC

Partner

It’s our mandate to understand, advise on and solve the complexities involved in transactions, financing and strategies at the interface between investors and investees.

Whether it’s raising funding for projects or procuring private sector partners for public sector entities, we deliver solutions that fund innovation, improve services, and regenerate communities.

With an extensive track record spanning more than three decades of providing authoritative, innovative advice on a wide range of transactions worldwide, our global experience and local knowledge enable ICONIC to deliver the integrated strategies and services our Business Partners require.

We work with Institutional Investors, Lending Institutions, Governments and Private Organizations in shaping their strategies, developing frameworks and helping them to implement their vision.

We reconcile investors’ need for profit with the requirements for risk mitigation.

As an independent adviser, we engineer a truly competitive process. And when advising investees, we help them to develop structures that allow them to access local and international funds.